Vivendi split into 4 companies

A disastrous project

The proposed spin-off of the Vivendi Group will be submitted for shareholder approval at the upcoming Annual General Meeting on December 9, 2024.

If approved, the three companies Canal+, Havas, and Louis Hachette Group, will become independent entities, each listed separately on the London Stock Exchange, Euronext Amsterdam, and Euronext Growth Paris.

The analysis uncovers surprising responses

- The smoke screen presented to shareholders

- The circumvention of rules and procedures

- The true objective: increasing the controlling shareholder’s power

01

The spin-off proposal

What does it involve? Under what conditions?

the story

December 2023: the project is announced

The Vivendi Group announces that it is studying a spin-off project, with few details. It is natural to think that the companies will be listed on Euronext Paris.

- 1On December 13, 2023, Vivendi announces that it is studying a project to split its activities into several entities.

- 2

The explanation

Vivendi explains that it suffers from a very high conglomerate discount that significantly reduces its valuation. - 3

The consequences

This discount limits its ability to carry out external growth operations for its subsidiaries. - 4

The goal

The spin-off should allow the full development potential of all these activities to be unleashed.

before/after

Company structure

Vivendi, a group listed on Euronext Paris

Groupe Canal+

Pôle France

Pôle international

StudiocanalLagardère (60.48%)

Lagardère Publishing

Lagardère Travel Retail

Lagardère News

Lagardère Live EntertainmentHavas

Havas Creative

Havas Media

Havas Health & YouPrisma media

Diffusion

PublicitéGameloft

OTT

Gameloft Business Solutions

Gameloft for BrandsVivendi Village

Billetterie

Festivals

Salles de spectacleNew initiatives

Dailymotion

Groupe Vivendi AfricaStakes

Telecom Italia

Prisa

MediaForEurope

Multichoice Group

Viu International Ltd

Viaplay Group AB

4 companies, listed on 4 different stock exchanges including 2 abroad

Canal+ Group

Canal+

DailyMotion

Multichoice group (45.2%)

Viu (36.8%)

Viaplay Group A.B (29.3%)

HAVAS N.V.

Havas Creative

Havas Media

Havas Health & You

Louis Hachette Group

Lagardère (66.53%)

Prisma Media

Groupe Vivendi

GAMELOFT 100%

MediaForEurope 19,79%

BANIJAY GROUP 19.2%

Telecom Italia 17%

Prisa 11,9%

UMG 9,98%

TELEFONICA 1%

Timeline

A calculated timing

Spin-Off Announcements: A Multi-Stage Plan

It is only at the end of July 2024 that the stock exchanges are revealed

Project Announcement

Vivendi explains...

Vivendi is experiencing a significant conglomerate discount, which is greatly reducing its valuation and limiting its ability to pursue external growth opportunities for its subsidiaries.

To fully unlock the growth potential of all its operations, the Management Board proposed to the Supervisory Board a plan to explore a spin-off into multiple entities, including Canal+, Havas, and an investment company. This spin-off would provide all operations with the necessary human resources and financial agility to support their growth.

Context

Financial markets welcomed the spin-off proposal. The stock saw a significant increase, indicating that the project appears promising.

VIV-PA Stock Price

8.96 €

Structuring into 4 Entities

Vivendi explains...

The Supervisory Board approved the Management Board’s proposal to structure the spin-off around four entities: Canal+, Havas, a new entity consolidating publishing and distribution assets (to become Louis Hachette Group), and an investment company.

The project must demonstrate its added value for all stakeholders and include an analysis of the tax implications of the various proposed transactions. Several key steps must be completed, including, “when the time comes, the consent of Vivendi shareholders.”

Context

The stock continues its upward trend, driven by news suggesting a well-executed spin-off.

VIV-PA Stock Price

10.29 €

The Surprise of the Stock Exchanges

Vivendi explains...

The study “demonstrated the feasibility of the project under satisfactory conditions and identified the most suitable stock exchanges for the three companies once separated from Vivendi.”

Canal+ will be listed on the London Stock Exchange “to reflect the company’s international scope.”

Havas will be listed as a Dutch public limited company (NV) on Euronext Amsterdam. To “stabilize its capital and ensure its independence,” a Dutch foundation will be established.

A new company, Louis Hachette Group, combining Lagardère SA and Prisma Media, will be listed on Euronext Growth Paris.

Context

Three days before the opening of the Olympic Games, the press is focused on the political turmoil following the dissolution of the National Assembly. However, the markets are displeased with the listing of the new entities on unregulated markets, leading to a decline in the stock price.

VIV-PA Stock Price

10.68 €

Notice of the General Meeting

Vivendi explains...

The Supervisory Board and the Management Board have agreed to convene a General Meeting of Shareholders to vote on the spin-off proposal on December 9, 2024, at 3:00 PM at the Folies Bergère, 32 rue Richer, 75009 Paris.

The Capital Market Days for Canal+ and Havas will be held on November 18 and 19, 2024, respectively. A live broadcast of both conferences will be available on the websites of the respective companies.

If the spin-off proposal is approved, the initial listing of shares for the three companies will occur on December 16, 2024. December 13, 2024, will be the deadline for investors wishing to participate in the spin-off to acquire Vivendi shares.

Context

A brief and slight rebound followed the announcement, but a new downward trend emerged once investors analyzed the proposal.

VIV-PA Stock Price

10.27 €

Publication of the Prospectuses

Steps

Announcement in the BALO (Bulletin of Mandatory Legal Announcements)

Publication of the Canal+ and Havas prospectuses

Spin-Off Agreement between Vivendi and Louis Hachette Group link

Management Board report on the partial spin-off project for Canal+, the partial spin-off project for Louis Hachette Group, and the exceptional in-kind distribution of Havas N.V. shares. link

Contexte

Nothing reassuring can be found in the documents presented. Analysts and institutional investors are not mistaken. Confidence in the spin-off project has been severely shaken. The verdict is clear: the stock falls below €10 on the same day. Two weeks later, it drops further below €9 (€8.89 on November 12, 2024), erasing nearly all the gains of the past year.

VIV-PA Stock Price

9.97 €

Vote at the General Meeting

Steps

Vote on the spin-off proposal at the Extraordinary General Meeting (EGM)

A two-thirds majority is required for Canal+ and Louis Hachette, and a 50% majority for Havas.

Context

Should we vote for the spin-off proposal at the General Meeting? A thorough review is essential.

VIV-PA Stock Price

?.? €

the market reaction

The market believes it's a good project...

The press and financial markets responded rather well to the initial project announcement in December 2023, as it aims to eliminate the discount.

Reuters

"Shares in media giant Vivendi surge on break-up planl," Reuters reported on December 14, 2023.

Financial Times

"Vincent Bolloré changes tack with Vivendi break-up plan. Growing valuation discount since Universal Music spin-out has been a source of frustration for French billionaire"

Challenges

"Havas, Canal+: Vincent Bolloré, the financier, makes a comeback by dismantling Vivendi. At 71, Vincent Bolloré embarks once again on a high-level financial maneuver."

...but when the stock exchanges are announced, the sentiment becomes negative

The enthusiasm dissipates when the press and analysts understand the reasons for the choice of stock exchanges

Le Monde

Caroline Ruellan denounces, in an opinion piece in "Le Monde", Vivendi's plan to split into three entities listed on three different exchanges, to the detriment of Paris.

The Controlling Shareholder

The Bolloré Group

29.9%

The media refers to the eponymous businessman as the architect of this spin-off because the Bolloré Group is the controlling shareholder of Vivendi, holding 29.9% of the shares.

What You Need to Know

At 30%, Mandatory Public Offer

30%

On Euronext Paris, a regulated market, any shareholder who exceeds the threshold of 30% ownership in a company automatically triggers a mandatory public offer (MPO), as stipulated by the General Regulation of the French Financial Markets Authority (AMF).

Under the Microscope

Vivendi's discount.

Vivendi's undervaluation on the stock market is not solely due to a holding discount; it also includes a governance discount of 15%, according to analysts. Together, these two discounts make up the conglomerate discount, which currently stands at approximately 40%.

Holding Discount

Governance Discount

02

But the chosen listing venues are a bad choice for shareholders

Canal+ on the London Stock Exchange, Havas on Euronext Amsterdam, Louis Hachette Group on Euronext Growth Paris, while Vivendi remains on Euronext Paris. Why were these stock exchanges chosen? Is this a choice favorable to shareholders?

Choice of Stock Exchanges

The London Stock Exchange, a bad choice for Canal+

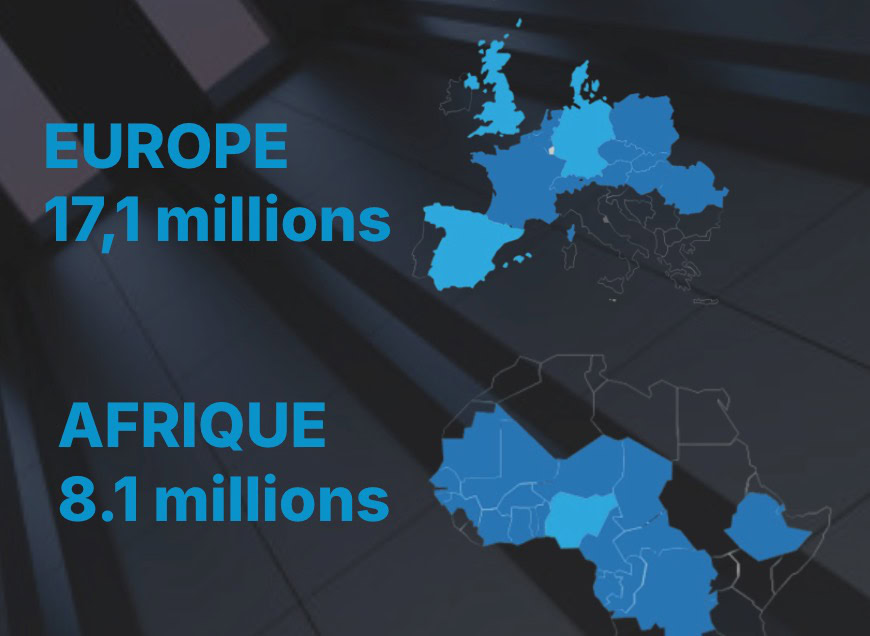

Vivendi believes Canal+ should be listed on the London Stock Exchange (LSE) due to the company's international scope. Indeed, "of the 26.4 million Canal+ subscribers, 63%, or 16.6 million, are located outside France, in over 50 countries."

Bloomberg

Number of London-Listed Companies Shrank 25% Over a Decade

In 2023, the total number of listings on the LSE decreased by 6%, reaching 1,836 companies, according to Bloomberg.

An unexpected boost for the LSE?

The London Stock Exchange would be the ideal market for Canal+, according to Vivendi. Is this true? To find out, simply look at what the Anglo-Saxon press thinks.

London’s snaring of France’s Canal+ to revive moribund listing market

According to the Financial Times, the potential listing of Canal+ on the London Stock Exchange (LSE) is seen as a significant boost for the exchange, which has faced challenges in attracting new listings in recent years. The addition of a major international media company like Canal+ is expected to enhance the LSE’s appeal to investors and issuers alike.

If everything goes as planned, it will provide a major boost to the struggling London stock market, even if no new capital is raised and no new investors are introduced at the time of admission, according to The ‘Investor’s Chronicle in an article dated November 1, 2024.

It is to be hoped that the potential listing of Canal+ (…) marks a turning point for the London market, explains the publication.

It’s not the London Stock Exchange that will help Canal+, it’s mainly Canal+ that will help the London Stock Exchange!

Choice of Stock Exchanges

What to make of Havas's listing on Amsterdam?

For those advocating the spin-off project, on Euronext Amsterdam, “Havas would be placed in the best conditions to implement its new global strategy, continue its solid growth as well as its strong commercial and creative momentum, and stabilize its capital.” Is this really the case?

Choice of Stock Exchanges

Listing Louis Hachette Group on Euronext Growth is a bad choice

According to Vivendi, Louis Hachette Group's market value will benefit from moving from Euronext A to the Euronext Growth market.

What remains?

Vivendi will no longer be a major player on Euronext A

According to the announcement, following the spin-off, Vivendi will remain a major player in creative industries and entertainment listed on Euronext Paris's regulated market.

Explanation

The Bolloré Group's Plan

to Increase Its Control

It all begins with Vivendi's share buyback

For Havas in Amsterdam...

2 - Euronext Amsterdam

A Public Offer is only mandatory when CROSSING the 30% ownership threshold in a Dutch company.

4 - All Shareholders Experience Accretion

Bolloré Group automatically increases from 29.9% of Vivendi to 31.04% of Canal+, Havas and LHG

1 - The Stock Repurchase

Vivendi has spent approximately 400 million euros on stock repurchases, including 250 million between early May and late August 2024

3 - At the Time of the Spin-off

Treasury shares do not carry rights to stakes in the new entities. Therefore, 991 million Canal+, Havas and LHG shares will be created instead of 1.03 billion Vivendi shares

5 - Tender Offer Avoided

Bolloré Group automatically crosses the 30% threshold without triggering a Mandatory Public Offer

03

This project does not serve the interests of retail shareholders

This project does not serve the interests of retail shareholders

Contrary to statements made, we believe the demerger proposal serves neither the interests of the companies involved nor those of Vivendi's shareholders

The discount will carry over to the newly formed entities

We expect Vivendi's conglomerate discount to carry over to each of the listed entities

The requirement for a mandatory takeover bid is removed

The demerger proposal represents a lost opportunity for shareholders, as the requirement for a mandatory takeover bid is eliminated due to the three chosen listing venues

Implications for retail shareholders

Retail shareholders will incur additional costs of €1.28 due to applicable taxation, representing 15% of Vivendi's current share price

We are compelled to vote AGAINST

In light of these factors, we are compelled to vote AGAINST all three resolutions presented at the General Meeting on 9 December

Prospectus risk factors

Our votes at the December 9, 2024 General Meeting

Resolution 1

VOTE NO

Approval of the partial spin-off project of Canal+ by Vivendi SE for Canal+'s admission to the London Stock Exchange (LSE)

Resolution 2

VOTE NO

Approval of the partial spin-off project of Louis Hachette Group (LHG) granted by Vivendi SE and its transfer from Euronext compartment A to Euronext Growth

Resolution 3

VOTE NO

Approval of the partial spin-off project of Havas granted by Vivendi SE for Havas's admission to Euronext Amsterdam